Support, guidance & advice for todays primary carers

Inheritance Planning: A Comprehensive Overview of 2024 Trends

Article by

Adjust text size:

The Inheritance & Retirement Report 2024 provides a detailed exploration of how Australian seniors are navigating inheritance planning in their later years. With responses from over 5,000 Australians aged 50 and above, the report offers a deep insight into their financial goals, family relationships, and strategies for ensuring financial security for the next generation. This article summarises key findings from the report, focusing primarily on inheritance and family legacies, with minimal emphasis on retirement planning.

Key Findings: The Importance of Inheritance Planning

The report highlights the significant role inheritance plays in the financial decisions of Australians aged 50 and above. Nearly 80% of seniors with children or grandchildren intend to leave an inheritance after they pass away, while 69% are considering doing so before their passing. The desire to leave a legacy is driven largely by concerns for the financial security of loved ones.

Concerns About Inheritance Planning

Despite the strong desire to leave a financial legacy, nearly 30% of respondents expressed anxiety about the amount they might leave behind, fearing it may not be enough for their children or grandchildren. Furthermore, 65% believe their children or grandchildren expect an inheritance, adding to the pressure.

Financial Adjustments for Inheritance Planning

Around 80% of seniors who plan to leave an inheritance have already made or are expecting to make financial adjustments to accommodate their goals. Many are cutting back on spending, working longer, or being more conservative with their finances in an effort to build a more substantial inheritance. Additionally, 89% of parents believe it is crucial to leave a financial legacy to secure their children’s future.

Inheritance Wishes and Plans

Inheritance Planning for Partners

For seniors with partners, a significant majority—84%—are likely to leave an inheritance to their significant other, with 54% rating their partner’s financial security as extremely important. In addition, many feel a sense of responsibility toward providing for their children’s future, with 69% feeling this obligation strongly.

Inheritance Planning for Children and Grandchildren

Many Australian seniors plan to leave an inheritance to their children and grandchildren, either before or after their passing. Of those surveyed, 69% had already or were considering leaving an inheritance before their death. Their motivations for doing so include providing financial security, minimising the burden on their family, and showing love and care beyond their lifetime.

Reasons for Leaving an Inheritance

For those over 50s planning to leave an inheritance, more than half (57%) cite reducing the financial burden on family members as a top reason. Ensuring financial security (55%) and helping loved ones achieve their goals (41%) also rank highly. Inheritance is seen not only as a financial contribution but also as a way of supporting family members in times of need and preserving the family’s standard of living.

10 key questions to consider when planning for an inheritance in the will:

These questions balance practical, financial, and emotional aspects of estate planning.

1. How much of my estate will I leave to each beneficiary?

2. Do I have a will or trust in place, and is it current?

3. Have I appointed a responsible executor for my estate?

4. Have I considered the tax implications of my inheritance for my beneficiaries?

5. How will debts and liabilities be handled upon my death?

6. Have I had conversations with my beneficiaries about their expectations and my intentions?

7. How will I handle unequal distribution to my children or loved ones?

8. Should I provide for family members with disabilities or special needs, and have I set up the appropriate provisions?

9. Do I want to allocate part of my estate for end-of-life care or funeral arrangements?

10. Have I sought professional advice from an estate planning attorney or financial advisor?

Funding Inheritance: How Seniors Are Planning Their Legacy

Methods of Leaving an Inheritance

Property remains a popular choice for many seniors when planning their estate. In fact, 62% of those surveyed plan to leave property to their beneficiaries. Cash savings (56%) and superannuation (49%) follow closely behind. Many seniors prefer to divide their assets equally among key beneficiaries, while others prioritise immediate family over extended relatives or make distributions based on personal relationships.

Affording an Inheritance

Balancing financial needs during one’s lifetime with the desire to leave an inheritance is a concern for many seniors. More than 61% of respondents expressed some level of worry about whether they could provide for their own needs while still leaving a substantial inheritance. Rising living costs, healthcare expenses, and insufficient savings were some of the common reasons contributing to these concerns.

Family Dynamics: The Emotional Side of Inheritance

Inheritance Discussions

The report reveals that inheritance discussions remain a delicate subject. While 59% of seniors are open to discussing their inheritance plans with family members, these conversations often require a careful balance. Transparency is important to avoid misunderstandings or disputes, but it can also create stress for some families. Almost one in five respondents were concerned about potential conflicts over the distribution of assets, with money and property being common sources of disagreement.

Managing Expectations

In addition to financial considerations, emotional factors weigh heavily on inheritance planning. Nearly two-thirds of seniors (65%) believe their children or grandchildren expect to receive an inheritance. This expectation adds an additional layer of pressure on seniors, many of whom are already concerned about whether they will be able to leave behind a sufficient amount.

Property and Legacy: Decisions About the Family Home

Plans for the Family Home

For many Australian seniors, the family home represents not only a major asset but also an important part of their legacy. Sixty percent of respondents said they plan to leave their home to their family, while 25% have decided not to. Among those with children, opinions are mixed regarding how the younger generation might feel about the sale or refinancing of the family home. Around one-third believe their children would not mind, but 20% expect their children to be very disappointed if the home were sold.

Downsizing for Financial Flexibility

Downsizing is an option many seniors consider as they grow older, with over half (51%) believing it will allow them to leave a larger inheritance for their family. However, the decision to downsize is often influenced by more than just financial considerations. Many seniors weigh the emotional and practical aspects of moving out of a family home they have lived in for decades.

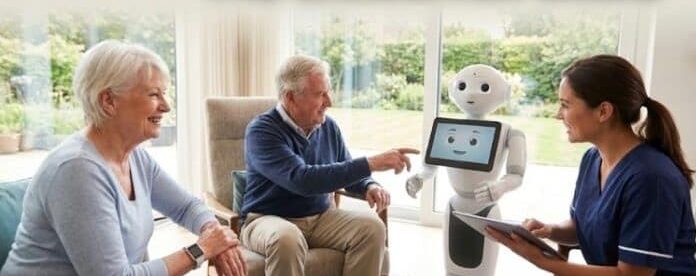

Assisted Living and Family Support in Later Years

Preferences for In-Home Care

The report finds that most seniors would prefer to stay at home with in-home care should they face difficulty living independently. Two-thirds of those with children and 72% of those without children would prefer this option over moving into a retirement or assisted living facility. Additionally, 34% are open to the idea of moving in with their children for reasons of comfort and familiarity, although 44% express concern about disrupting family dynamics.

Concerns About Assisted Living

Many seniors view assisted living with a certain degree of hesitation. While 43% feel either neutral or positive about moving into retirement homes or assisted living communities, another 40% are more cautious or negative about the idea. Financial concerns also play a role, with 57% of respondents saying they believe retirement homes are unaffordable, and 46% stating they had not considered the cost of such living arrangements in their inheritance plans.

Organising a Will: Legal Preparations for the Future

Creating and Updating a Will

Estate planning is a critical step for many seniors. As of 2024, nearly two-thirds of Australians aged 50 and over (64%) have a will that clearly outlines how their estate will be distributed upon their passing. However, this figure is lower than in previous years, down from 72% in 2018. For those without a will, the primary reasons for delaying include procrastination (45%) and the belief that they do not have enough assets to justify creating one.

Discussing Wills with Family

Discussing wills and inheritance plans with family members can help avoid future conflicts. Nearly 70% of seniors involve their partners or family members in their estate planning discussions to clarify their intentions and ensure their wishes are understood. Having these conversations early and openly is key to preventing misunderstandings and promoting family harmony.

Conclusion: Navigating the Complexities of Inheritance Planning

The *Inheritance & Retirement Report 2024* offers valuable insights into how Australian seniors are approaching inheritance planning. From concerns about leaving a sufficient financial legacy to the emotional aspects of family discussions, the report highlights the importance of both financial planning and open communication. As Australians over 50 navigate the complexities of inheritance, balancing personal needs with the desire to leave a meaningful legacy remains a top priority.

Ageing Technology in Australia:

New My Aged Care website

The Heart Behind The Carer:

Celebrating our 3 Million Informal Carers

Support at Home Pricing:

What’s Really Behind the Rising Costs?

Healing Paws: Bringing Comfort, Connection & Joy

I would not have been able to purchase my new property without the assistance of HACK MAVENS CREDIT SPECIALIST, who aided me in removing all negative entries from my credit report and raised my score from 550 to 830+ across all three credit bureaus. Should you require his services, You can reach him via email at H A C K M A V E N S 5 AT G M A I L DOT COM or call/text/Whats-App at [+1 (2 0 9) 4 1 7 – 1 9 5 7]. You can thank me later.

I was diagnosed with Herpes four years ago. For over two years, I relied on prescribed medications and treatments, but unfortunately, my condition continued to worsen. The flare-ups became more frequent, the discomfort increased, and even simple daily tasks became difficult to manage.Last year, out of desperation and hope, I decided to try a herbal treatment program from NaturePath Herbal Clinic. Honestly, I was skeptical at first, but within a few months of starting the program, I felt some changes. My discomfort eased, my energy levels improved, and I felt I had more control over my daily life again.It’s been a meaningful experience for me, and I feel more like myself than I have in years. This is simply my personal story. You can visit their website at http://www.naturepathherbalclinic.com

whatsapp +27604189106

OPIPLJIVE INFORMACIJE O BOŽIĆNOM KREDITU ZA PLANIRANJE…

Ovo nije normalna objava koju svakodnevno vidite na internetu gdje ljudi daju lažne recenzije i lažne informacije o izvrsnoj financijskoj pomoći. Svjestan sam da su mnogi od vas prevareni i da su lažni agenti iskoristili one koji traže kredite. Neću ovo nazvati normalnim recenzijama, nazvat ću ovo situacijom u kojoj sam živi svjedok kako možete dobiti svoj kredit kada ispunjavate uvjete tvrtke. Zaista nije važno imate li dobar kreditni rejting ili odobrenje vlade, sve što vam treba je važeća osobna iskaznica i važeći IBAN broj da biste mogli podnijeti zahtjev za kredit s kamatnom stopom od 3%. Minimalni iznos je 1000 eura, a maksimalni iznos koji se može posuditi je 100.000.000 eura. Dajem vam 100% jamstvo da možete dobiti svoj kredit putem ove pouzdane i poštene tvrtke, posluju 24 sata online i pružaju kredite svim građanima Europe i izvan Europe. Poslali su mi dokument koji je provjeren i testiran prije nego što sam dobio kredit, stoga pozivam sve kojima je potreban kredit da ih posjete ili kontaktiraju putem e-maila: michaelgardloanoffice@gmail.com

WhatsApp za Europu: +38591560870

WhatsApp za SAD: +1 (717) 826-3251

Nakon što ih kontaktirate, javite im da vam je gospođa Dejana Ivica iz Zagreba dala informacije. Vidjeti znači vjerovati i zahvalit ćete mi kasnije kada dobijete kredit od njih. Dao sam obećanje da ću nakon što dobijem kredit od njih, objaviti dobru vijest svima online. Ako imate prijatelje ili rodbinu, uključujući kolege, možete im reći za ovu ponudu i da se događa ovog BOŽIĆNOG VRIJEME.

HIRING GENUINE HACKERS TO CONSULT RECOVERY SPECIALISTS

I want to sincerely thank Safeguard Recovery Expert for their extraordinary skill; they are real heroes, and I wish I had met them sooner rather than reaching out to other hackers for help. If you read this comment, you might be able to get your hacked or blocked bitcoin investment back. I’m posting it for anybody who have been affected by cryptocurrency investment, mining, and trading frauds.

Email:

safeguardbitcoin@consultant.com

safeguardbitcoin.wixsite.com/safeguard-bitcoin–1

WhatsApp: +44 7426 168300