Support, guidance & advice for todays primary carers

Seniors top scammers’ hit list

Article by

Adjust text size:

The good news is Australians are losing less to scammers. The bad news is scammers have lifted their criminal activity to record levels resulting in a record number of scams reported to authorities.

The even worse news is older people lose the most to scammers. The ACCC found that people over 65 were the only age group to experience an increase in reported losses. In 2023, those losses increased by 13.3% to $120 million.

People over the age of 65 were disproportionally impacted by investment scams. Many reported significant losses after being contacted by scammers through social media.

The ACCC suspects these criminals are preying on seniors and retirees looking for investment opportunities.

Be aware of scammers techniques

One elderly woman lost her life savings after seeing a deepfake Elon Musk video on social media, clicking the link, and registering her details online.

She was assigned a “financial advisor” and given access to an online dashboard where she could see that her “investment” was apparently making returns, but she couldn’t withdraw her money.

Seniors looking for paid work to supplement their retirement income also should be aware of job recruitment scams.

The ACCC has reiterated its warning that scammers are financial criminals who use sophisticated technology and psychology to rob Australians of their money and personal information.

They do this through:

- Text messages, which were the most reported contact method with 109,621 reports (37.3% increase on 2022).

- Scam calls, which resulted in the highest reported losses at $116 million.

- Scams in which contact occurred via social media resulted in the second highest in reported losses, increasing by 16.5% to $93.5 million.

- Job scams – losses rose by 151.2 % to just over $24.3 million. People from culturally and linguistically diverse (CALD) communities were disproportionally impacted by job scams, as were people looking for part-time work or seeking to supplement their income and ease cost of living pressures.

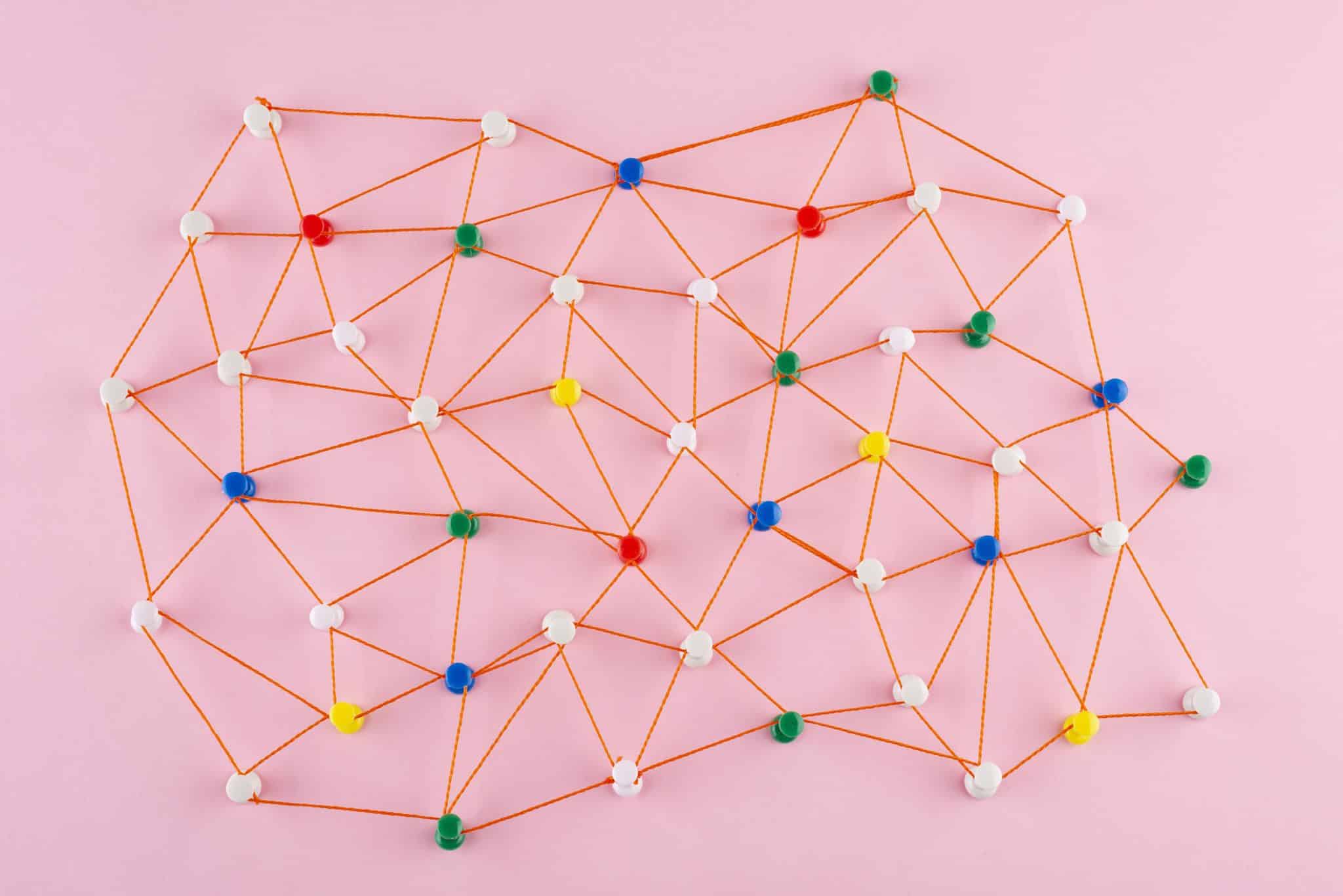

In a statement, the ACCC said it was ramping up anti-scam strategies. These include technology-based solutions that will centralise intelligence and distribute information to those who can act on it – such as banks to freeze accounts, telcos to block calls or text messages (SMS), and digital platforms to take down websites or accounts.

Scamming statistics

The National Anti-Scam Centre’s efforts to date, as reported in the latest Targeting Scams report reveals a 13.1% decline in reported losses to $2.74 billion in 2023.

Australians made over 601,000 scam reports – an 18.5% increase on 2022.

Investment scams continued to cause the most harm ($1.3 billion), followed by remote access scams ($256 million) and romance scams ($201.1 million).

With scam activity on the rise globally in recent years, the report highlights the impact of targeted and coordinated disruption activities across government, industry, law enforcement and community organisations, leading to lower overall financial losses.

“It is encouraging to see signs that our coordinated scam prevention, detection and disruption initiatives can stem the flow of funds to criminals and protect consumers,” ACCC Deputy Chair Catriona Lowe said.

Before investing, make these simple practical checks to help reduce the risk of scams:

- Check ASIC’s Offer Notice Board to see if a prospectus relates to a registered offer.

- Check ASIC’s register of Australian financial services licensees to make sure any party promoting or issuing the financial product is licensed.

- Check the International Organization of Securities Commission’s (IOSCO) investor alerts.

If you think you might be involved in a scam, contact your bank immediately. You can also report to police here.

You can access support from IDCARE, a national identity and cyber support service.

This article was originally published by our friends at National Seniors.

OPIPLJIVE INFORMACIJE O BOŽIĆNOM KREDITU ZA PLANIRANJE…

Ovo nije normalna objava koju svakodnevno vidite na internetu gdje ljudi daju lažne recenzije i lažne informacije o izvrsnoj financijskoj pomoći. Svjestan sam da su mnogi od vas prevareni i da su lažni agenti iskoristili one koji traže kredite. Neću ovo nazvati normalnim recenzijama, nazvat ću ovo situacijom u kojoj sam živi svjedok kako možete dobiti svoj kredit kada ispunjavate uvjete tvrtke. Zaista nije važno imate li dobar kreditni rejting ili odobrenje vlade, sve što vam treba je važeća osobna iskaznica i važeći IBAN broj da biste mogli podnijeti zahtjev za kredit s kamatnom stopom od 3%. Minimalni iznos je 1000 eura, a maksimalni iznos koji se može posuditi je 100.000.000 eura. Dajem vam 100% jamstvo da možete dobiti svoj kredit putem ove pouzdane i poštene tvrtke, posluju 24 sata online i pružaju kredite svim građanima Europe i izvan Europe. Poslali su mi dokument koji je provjeren i testiran prije nego što sam dobio kredit, stoga pozivam sve kojima je potreban kredit da ih posjete ili kontaktiraju putem e-maila: michaelgardloanoffice@gmail.com

WhatsApp za Europu: +38591560870

WhatsApp za SAD: +1 (717) 826-3251

Nakon što ih kontaktirate, javite im da vam je gospođa Dejana Ivica iz Zagreba dala informacije. Vidjeti znači vjerovati i zahvalit ćete mi kasnije kada dobijete kredit od njih. Dao sam obećanje da ću nakon što dobijem kredit od njih, objaviti dobru vijest svima online. Ako imate prijatelje ili rodbinu, uključujući kolege, možete im reći za ovu ponudu i da se događa ovog BOŽIĆNOG VRIJEME.

HIRING GENUINE HACKERS TO CONSULT RECOVERY SPECIALISTS

I want to sincerely thank Safeguard Recovery Expert for their extraordinary skill; they are real heroes, and I wish I had met them sooner rather than reaching out to other hackers for help. If you read this comment, you might be able to get your hacked or blocked bitcoin investment back. I’m posting it for anybody who have been affected by cryptocurrency investment, mining, and trading frauds.

Email:

safeguardbitcoin@consultant.com

safeguardbitcoin.wixsite.com/safeguard-bitcoin–1

WhatsApp: +44 7426 168300