Support, guidance & advice for todays primary carers

Changes to Home Care from November 2025

Article by

Adjust text size:

Unless you are protected under the ‘no worse off principle’ (grandfathering provisions – discussed below), all new entrants will be expected to contribute financially towards this program.

In this article, we discuss the new fees and explore hardship provisions for those who may not be able to afford their co-contributions under the program.

Support at Home Program

The Support at Home program introduces a fee-for-service model designed to streamline aged care arrangements and make the system more sustainable. Participants only pay for the services they receive, with co-contributions now required for all independence and everyday living services, subject to means testing. Clinical services will remain fully funded by the government, ensuring equitable access to medical care regardless of financial means. This shift aims to address the previously low co-contribution rates and guarantee the sustainability of the system as demand rises.

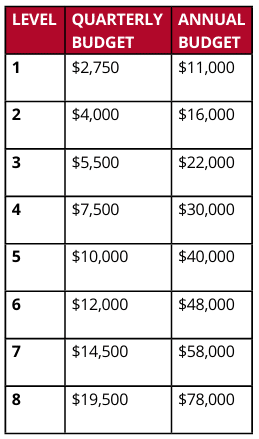

Support at Home Package Budgets

From November 2025, assets are added to the means assessment, not just income. This major change focuses on overall wealth (excluding the principal residence in most cases).

Support at Home introduces eight care package levels, greatly expanding flexibility compared to the previous four levels under the Home Care Package system. Package budgets comprise both government funding and client contributions. Providers charge a standard care management fee equal to 10% of the budget per quarter, which reduces the amount available for direct services.

There are also two additional forms of support:

• Restorative Care Pathway: Funding of $6,000 over 12 weeks, with possible extension for another $6,000 if needed.

• End-of-Life Pathway: Funding of $25,000 over 12 weeks.

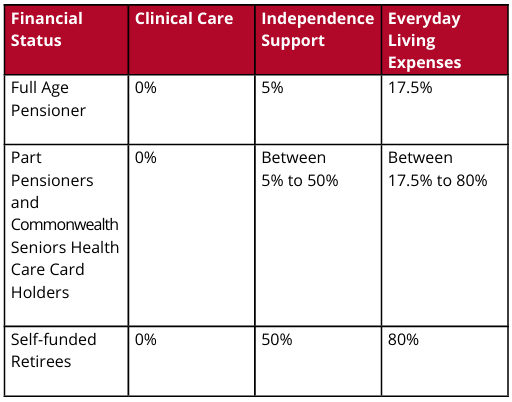

Client Contributions & Payment Rates

Clients will pay a percentage of their service costs. The percentage is determined by their financial situation and type of service utilised, as per the table below:

CSHC (Commonwealth Seniors Health Card) holders are considered self-funded retirees unless they disclose finances for assessment to Services Australia.

Non means tested income support recipients such as Blind pension and War Widow pensioners must disclose finances or will be treated as self-funded retirees.

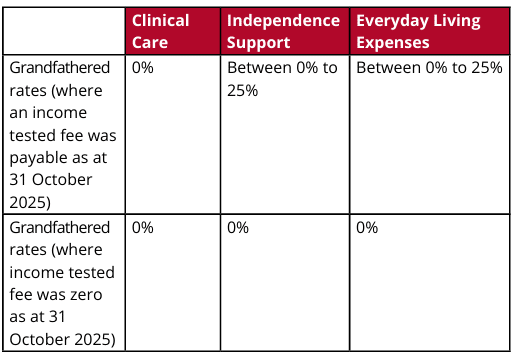

Grandfathering Provisions

If deemed ‘grandfathered’ (in receipt of a Home Care package or on the National Prioritisation System waitlist or approved for a package as at 12 Sep 2024), the contributions under Support at Home will be capped as follows:

Hardship Application Process

Participants experiencing financial hardship can apply for the Fee Reduction Supplement via Services Australia, using the SA462 Hardship Application form. You’ll need to download the new form as this changed from November 2025 to include assets for Support at Home.

The eligibility requirements include:

• Assessable assets cannot exceed $45,969.30 (indexed in September and March each year in line with the Age Pension).

• Further to the above point, there may be assets that are considered unrealisable (i.e. not able to be sold or borrowed against). These are excluded from the assessable assets above.

• A participant cannot deprive themselves of assets – Strict gifting rules apply. If these have been breached, you will not qualify.

• After paying for your essential expenses you are left with income equivalent to less than 15% of the Age Pension each fortnight (currently $176.80 per fortnight).

If successful, hardship arrangements cap participant contributions for up to three years. While the claim is being assessed, contributions are suspended, but if the application is rejected, these fees must be paid. If an applicant cannot obtain proof for certain expenses, partial hardship relief may still be granted.

Contribution Caps

All client contributions are subject to a lifetime cap (indexed). The current cap is $135,318.69.

Other Avenues for Assistance

The National Debt Helpline and MoneySmart offer financial counselling and budgeting advice.

• Services Australia provides Aged Care Specialist Officers and the Financial Information Service

for guidance. These are free services available to everyone, regardless of their income and assets.

• The Older Persons Advocacy Network gives free, independent support and can help with hardship

applications.

• These organisations also offer resources for those not eligible for hardship assistance, recommending financial planning and education to improve outcomes.

These detailed reforms reflect a commitment to balancing funding pressures with equity, ensuring older Australians can access quality care without being financially overwhelmed.

Tips for Participants

• BEGIN EARLY:

Spreadsheet all income and expenses, collect invoices and create thorough records.

• CHECK ELIGIBILITY:

Use the My Aged Care website to estimate fees. From 1 October 2025, Services Australia can provide current pensioners and home care package recipients with an estimate of what your Support at Home contributions will be based on the information they hold on file for you.

Call 1800 227 475 to request this.

• COMPLETE ALL QUESTIONS: Partial answers delay assessments; full documentation speeds up decisions.

• SEEK INDEPENDENT ADVICE AND SUPPORT:

Professional assistance reduces errors and stress, guiding through complex forms and processes.

At We Plan Financial Advisers, we can assist you with understanding your contributions and how to fund this, as well as provide assistance with navigating the aged care system and general advocacy.

Call 03 8526 8961 to make an appointment.

DISCLAIMER: This information is of a general nature only and neither represents nor is intended to be specific advice on any particular matter. We strongly suggest that no person should act specifically on the basis of the information contained herein but should seek appropriate professional advice based upon their own personal circumstances. Although we consider the sources for this material reliable, no warranty is given and no liability is accepted for any statement or opinion or for any error or omission. Past performance is not a reliable indicator of future performance.

This information is current as at 15 November 2025.

AUTHOR: Rosie Bouton CFP® – Financial Adviser, We Plan Financial Advisers Pty Ltd

Aged Care and Centrelink/DVA Specialist, Accredited Aged Care Professional, MFinPlan Authorised Representative No.1261297

rosie@weplanfinancial.com.au

The Home Essentials Every Carer Needs

Changes to Home Care from November 2025

Understanding the 8 Support at Home Classifications

Do you know exactly what your

Home Care Package can cover?

Could You Get More Care from Your Home Care Package?

I was diagnosed with Herpes four years ago. For over two years, I relied on prescribed medications and treatments, but unfortunately, my condition continued to worsen. The flare-ups became more frequent, the discomfort increased, and even simple daily tasks became difficult to manage.Last year, out of desperation and hope, I decided to try a herbal treatment program from NaturePath Herbal Clinic. Honestly, I was skeptical at first, but within a few months of starting the program, I felt some changes. My discomfort eased, my energy levels improved, and I felt I had more control over my daily life again.It’s been a meaningful experience for me, and I feel more like myself than I have in years. This is simply my personal story. You can visit their website at http://www.naturepathherbalclinic.com

whatsapp +27604189106

OPIPLJIVE INFORMACIJE O BOŽIĆNOM KREDITU ZA PLANIRANJE…

Ovo nije normalna objava koju svakodnevno vidite na internetu gdje ljudi daju lažne recenzije i lažne informacije o izvrsnoj financijskoj pomoći. Svjestan sam da su mnogi od vas prevareni i da su lažni agenti iskoristili one koji traže kredite. Neću ovo nazvati normalnim recenzijama, nazvat ću ovo situacijom u kojoj sam živi svjedok kako možete dobiti svoj kredit kada ispunjavate uvjete tvrtke. Zaista nije važno imate li dobar kreditni rejting ili odobrenje vlade, sve što vam treba je važeća osobna iskaznica i važeći IBAN broj da biste mogli podnijeti zahtjev za kredit s kamatnom stopom od 3%. Minimalni iznos je 1000 eura, a maksimalni iznos koji se može posuditi je 100.000.000 eura. Dajem vam 100% jamstvo da možete dobiti svoj kredit putem ove pouzdane i poštene tvrtke, posluju 24 sata online i pružaju kredite svim građanima Europe i izvan Europe. Poslali su mi dokument koji je provjeren i testiran prije nego što sam dobio kredit, stoga pozivam sve kojima je potreban kredit da ih posjete ili kontaktiraju putem e-maila: michaelgardloanoffice@gmail.com

WhatsApp za Europu: +38591560870

WhatsApp za SAD: +1 (717) 826-3251

Nakon što ih kontaktirate, javite im da vam je gospođa Dejana Ivica iz Zagreba dala informacije. Vidjeti znači vjerovati i zahvalit ćete mi kasnije kada dobijete kredit od njih. Dao sam obećanje da ću nakon što dobijem kredit od njih, objaviti dobru vijest svima online. Ako imate prijatelje ili rodbinu, uključujući kolege, možete im reći za ovu ponudu i da se događa ovog BOŽIĆNOG VRIJEME.

HIRING GENUINE HACKERS TO CONSULT RECOVERY SPECIALISTS

I want to sincerely thank Safeguard Recovery Expert for their extraordinary skill; they are real heroes, and I wish I had met them sooner rather than reaching out to other hackers for help. If you read this comment, you might be able to get your hacked or blocked bitcoin investment back. I’m posting it for anybody who have been affected by cryptocurrency investment, mining, and trading frauds.

Email:

safeguardbitcoin@consultant.com

safeguardbitcoin.wixsite.com/safeguard-bitcoin–1

WhatsApp: +44 7426 168300