Support, guidance & advice for todays primary carers

A New World of Aged Care Costs

Article by

Adjust text size:

Since 1 November 2025, Australia’s aged care system has been operating under new rules, reshaping how people pay for care at home and in residential care. The aged care reforms marked the biggest overhauls in almost three decades.

For anyone arranging care, for themselves or a loved one, the key to navigating the new system is understanding how contributions are calculated, how your assets and income are assessed, how the caps work, and how the family home fits into the picture.

Support at Home

The Support at Home program replaced the old Home Care Packages and Short-Term Restorative Care programs. It also introduced two new initiatives — the Assistive Technology and Home Modifications Scheme, and the End-of-Life Pathway.

Under the new program, funding for Assistive Technology and Home Modifications is available upfront (up to $15,000). This means older Australians can access ramps, bathroom modifications, mobility aids, and other supports sooner as they don’t need to wait for funds to accumulate. The End-of-Life Pathway provides up to $25,000 for palliative care services at home during the final three months of life.

Support at Home also expanded the previous four levels of Home Care Packages to eight levels, with the maximum value of the package increasing to just over $78,000 per year.

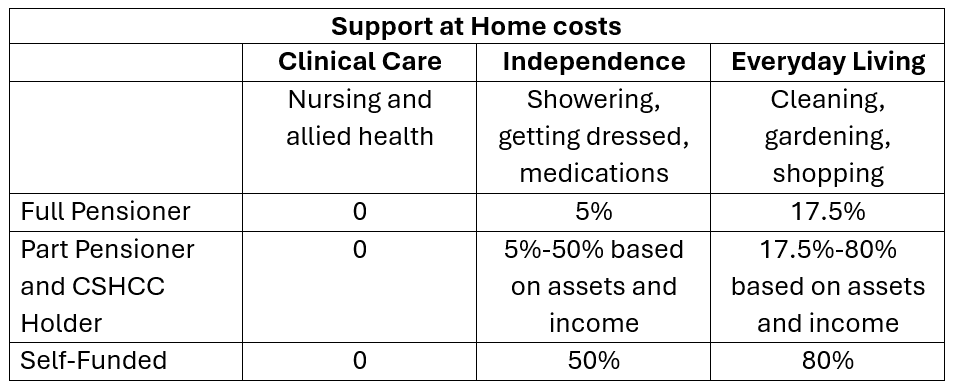

Your Support at Home services are grouped into three categories:

- Clinical Care – funded by the government. You don’t pay a contribution towards these services.

- Independence Services – such as showering, dressing and social support, you contribute between 5% and 50% towards the services based on your income and assets.

- Everyday Living Services – such as cleaning, shopping, and meals, where contributions are between 17.5% and 80% based on your means.

Your contributions are calculated by Services Australia based on your assessable assets and income. As a general rule any asset you own or have an interest in worldwide will be included in your assets at the market value with special rules applying to your home. Your assessable income includes deemed income on your investments (bank accounts, shares, superannuation), taxable income from private trusts, companies and investment properties, overseas pensions and most income support payments, such as the Age Pension.

Your Support at Home contributions count towards the lifetime cap of $135,319 together with any non-clinical care contributions you make towards residential aged care in the future.

Residential Aged Care Under the New Rules

The reforms also brought major changes to residential aged care, though the core structure is similar to Support at Home: the government funds your clinical care and you pay towards everything else.

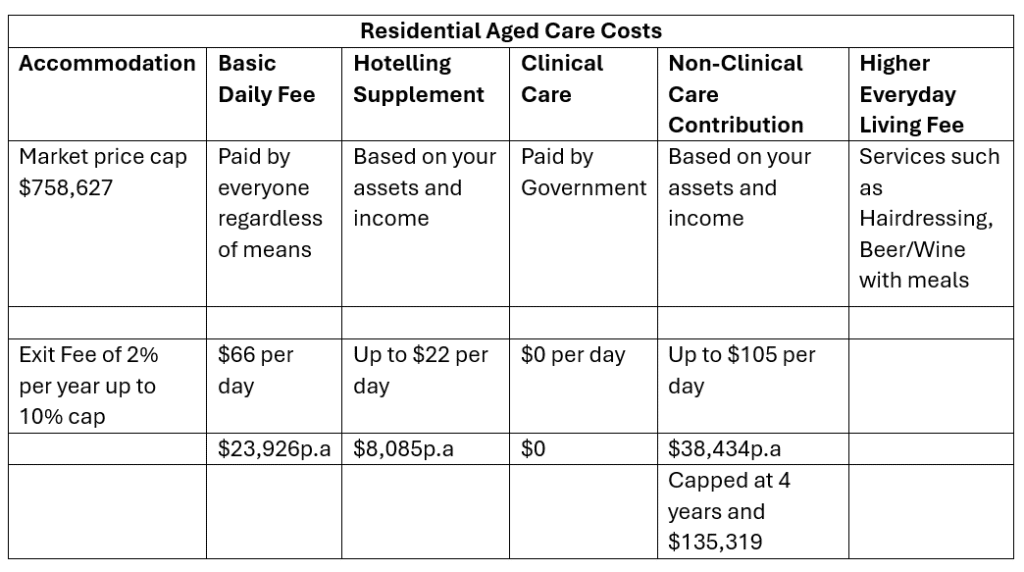

A market price cap of $758,627 applies to Refundable Accommodation Deposits (RADs), prices above this require government approval. It is up to you whether you pay for your accommodation by a lump sum (RAD), daily payment (DAP) or a combination.

The Daily Payment is calculated on any unpaid lump sum at a government set interest rate, as at 1 November that was 7.61%p.a. So, if your RAD is $700,000 and you paid $200,000 as a lump sum your DAP would be $104 per day. The DAP is indexed twice a year in line with CPI.

From 1 November 2025, an Exit Fee was introduced on Refundable Accommodation Deposits (RADs). Aged care homes can now deduct 2% of your RAD for each year you live there, capped at 10% after five years. So, if you pay a RAD of $700,000 and stay for five years or more, $70,000 will be retained by the provider when you leave.

When it comes to your ongoing cost of residential care, you will pay the Basic Daily Fee, set at 85% of the Age Pension, to cover everyday living expenses such as meals, laundry, and utilities. Beyond that you will pay a Hotelling Supplement and a Non-Clinical Care Contribution based on your assets and income.

Those who opt for extras like wine, hairdressing or streaming services will also pay a higher everyday living fee. Your non clinical care contribution counts towards the lifetime cap of $135,319 – there is also a time cap of 4 years, once you reach the cap (whichever comes first) you will stop paying the non-clinical care contribution.

The Family Home: Special Treatment

The family home remains the most sensitive part of the means test, and it still receives special treatment under the new system.

For the aged care means test if a protected person such as a spouse, dependent child, or carer lives in your home, it is exempt from your aged care assets. If not, the home is counted up to a capped value of $210,555. For pension purposes your home has a 2-year asset test exemption from the day you or your partner (whichever is later) move into aged care.

The smartest way to pay for aged care

How you pay for aged care can have significant financial implications, it can affect your pension, cash flow, tax and later on your estate planning wishes. How you pay for care will also directly affect what it costs.

There are lots of myths about how you should pay for aged care, a common one is that the government or the aged care home will force you to sell your home to pay the RAD. It’s not true and it’s a strategy that could cost you tens of thousands of dollars a year in lost pension and increased aged care costs, not to mention the emotional toll it can take. The smartest way to pay for your aged care is going to depend on your situation and the aged care you receive. Financial advice from a Retirement Living and Aged Care Specialist is a good investment. With the family home, investments, and income all influencing what you pay, aged care remains one of life’s biggest financial decisions.

The best advice? Don’t wait until crisis hits. Understanding your options early and getting help from a financial adviser who knows aged care can make all the difference between stress and peace of mind.

OPIPLJIVE INFORMACIJE O BOŽIĆNOM KREDITU ZA PLANIRANJE…

Ovo nije normalna objava koju svakodnevno vidite na internetu gdje ljudi daju lažne recenzije i lažne informacije o izvrsnoj financijskoj pomoći. Svjestan sam da su mnogi od vas prevareni i da su lažni agenti iskoristili one koji traže kredite. Neću ovo nazvati normalnim recenzijama, nazvat ću ovo situacijom u kojoj sam živi svjedok kako možete dobiti svoj kredit kada ispunjavate uvjete tvrtke. Zaista nije važno imate li dobar kreditni rejting ili odobrenje vlade, sve što vam treba je važeća osobna iskaznica i važeći IBAN broj da biste mogli podnijeti zahtjev za kredit s kamatnom stopom od 3%. Minimalni iznos je 1000 eura, a maksimalni iznos koji se može posuditi je 100.000.000 eura. Dajem vam 100% jamstvo da možete dobiti svoj kredit putem ove pouzdane i poštene tvrtke, posluju 24 sata online i pružaju kredite svim građanima Europe i izvan Europe. Poslali su mi dokument koji je provjeren i testiran prije nego što sam dobio kredit, stoga pozivam sve kojima je potreban kredit da ih posjete ili kontaktiraju putem e-maila: michaelgardloanoffice@gmail.com

WhatsApp za Europu: +38591560870

WhatsApp za SAD: +1 (717) 826-3251

Nakon što ih kontaktirate, javite im da vam je gospođa Dejana Ivica iz Zagreba dala informacije. Vidjeti znači vjerovati i zahvalit ćete mi kasnije kada dobijete kredit od njih. Dao sam obećanje da ću nakon što dobijem kredit od njih, objaviti dobru vijest svima online. Ako imate prijatelje ili rodbinu, uključujući kolege, možete im reći za ovu ponudu i da se događa ovog BOŽIĆNOG VRIJEME.

HIRING GENUINE HACKERS TO CONSULT RECOVERY SPECIALISTS

I want to sincerely thank Safeguard Recovery Expert for their extraordinary skill; they are real heroes, and I wish I had met them sooner rather than reaching out to other hackers for help. If you read this comment, you might be able to get your hacked or blocked bitcoin investment back. I’m posting it for anybody who have been affected by cryptocurrency investment, mining, and trading frauds.

Email:

safeguardbitcoin@consultant.com

safeguardbitcoin.wixsite.com/safeguard-bitcoin–1

WhatsApp: +44 7426 168300